Xero - Financial Analytics#

The Xero-Financial Analytics Integration enables seamless connectivity between your Xero account and the analytics platform, allowing you to transform raw financial data into powerful business insights.

Through this integration, users can automatically import accounting data, generate real-time dashboards, and access preconfigured storyboards that visualize critical financial and operational metrics.

This integration is designed to help:

Finance teams monitor cash flow, revenue, and expenditures efficiently.

Business leaders make data-driven decisions backed by real-time insights.

Operations and procurement teams identify cost-saving opportunities and optimize processes.

Whether you’re tracking receivables, analyzing payables, or assessing overall financial health, the Xero Financial Analytics Integration offers an intelligent, visual way to understand your business performance.

Getting Started#

After purchasing Xero Financial Analytics from MarketSpace, users are guided through a seamless onboarding flow to complete the integration setup.

Step 1: Navigate to the Xero block in MarketSpace

Step 2: Click the Launch button to initiate the integration process.

Step 3: Once launched, the system will automatically create the required Xero Datasets.

This process may take a few seconds.

When the dataset status updates to Active, the integration is complete.

Step 4: After activation, you will be redirected to the Storyboard tab, where a set of preconfigured storyboards will be automatically created and ready to use.

These storyboards provide powerful insights across various business functions, helping users track performance, optimize financial operations, and make data-driven decisions.

Storyboard Categories#

Decision Intelligence#

The Decision Intelligence category focuses on operational and financial efficiency, providing insights to guide strategic decisions across cash flow, payments, and procurement.

The following are the storyboards available in Decision Intelligence:

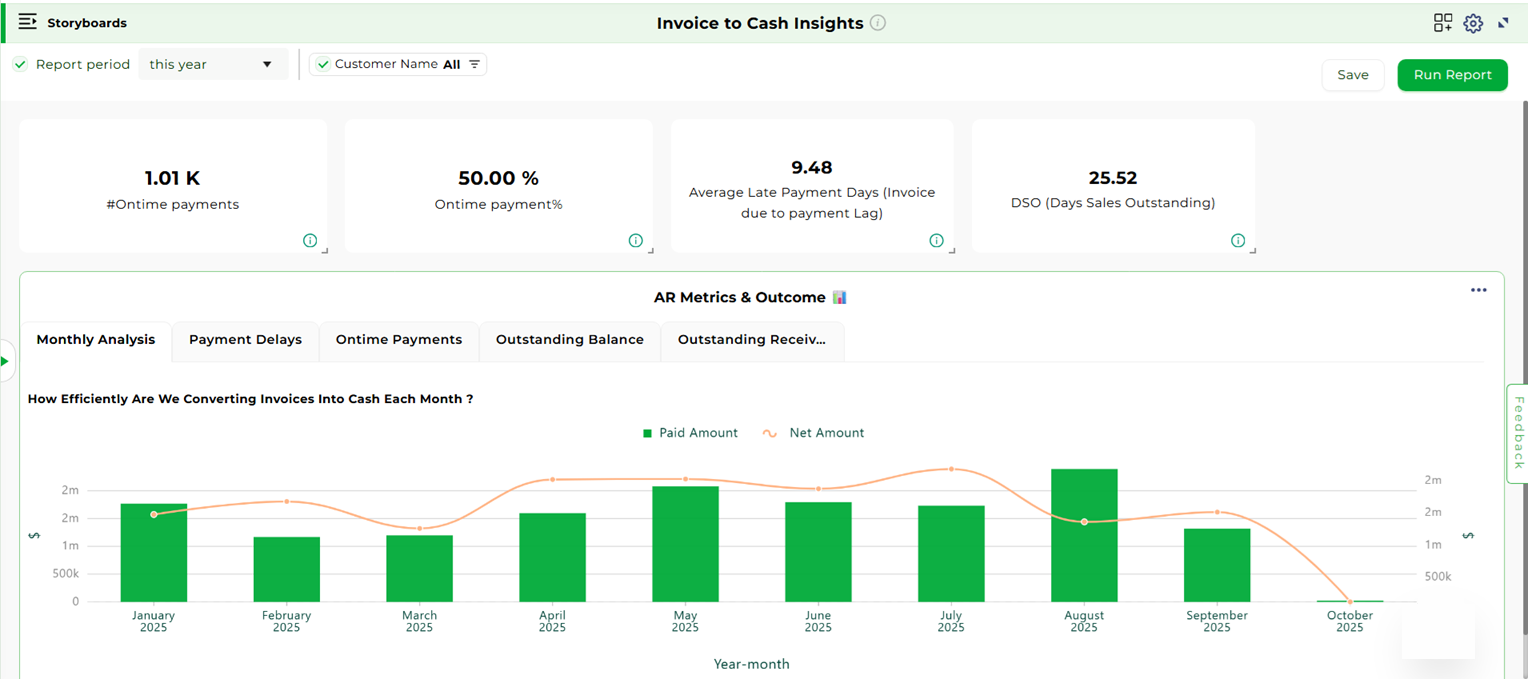

Invoice to Cash Insights

Visualizes the End-To-End Invoicing process — from invoice creation to payment collection. Helps identify payment delays, customer behavior trends, and overall cash inflow efficiency.

Invoice to Cash#

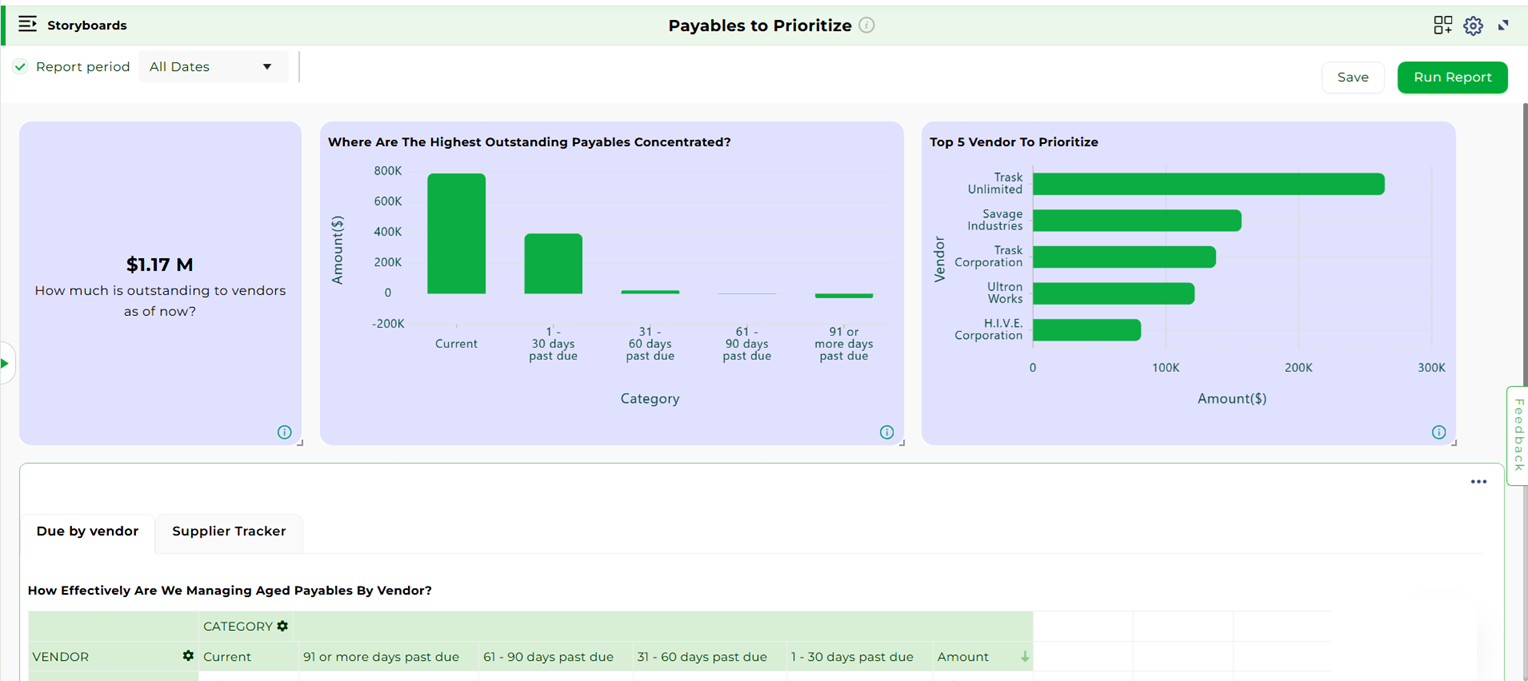

Payables to Prioritize

Analyzes outstanding Payables, Vendor Payment Timelines, and Priority Payments. Supports effective cash flow planning and vendor relationship management by identifying critical payment obligations.

Payables to Prioritize#

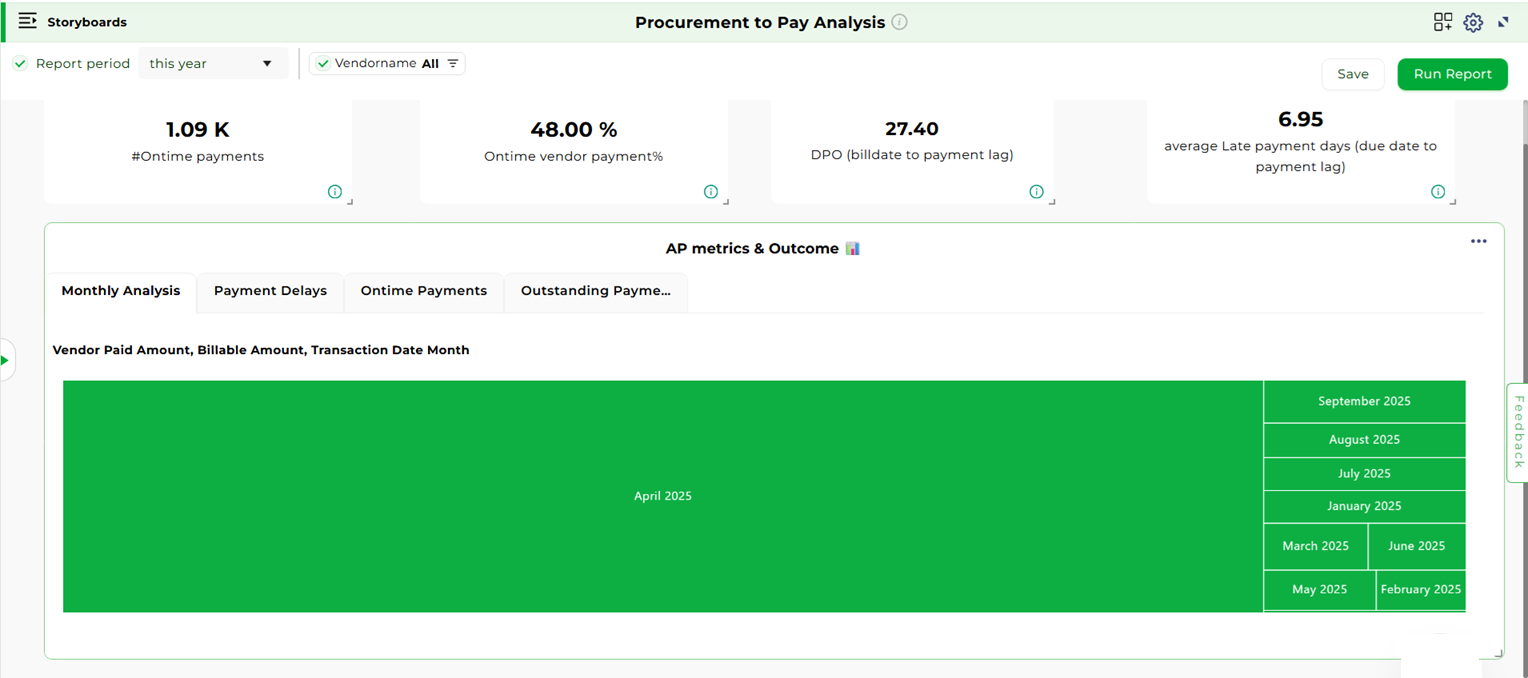

Procurement to Pay Analysis

Offers visibility into the Procurement Lifecycle, from purchase requisitions to vendor payments. Enables users to detect inefficiencies, track spending patterns, and manage supplier performance.

Procurement to Pay Analysis#

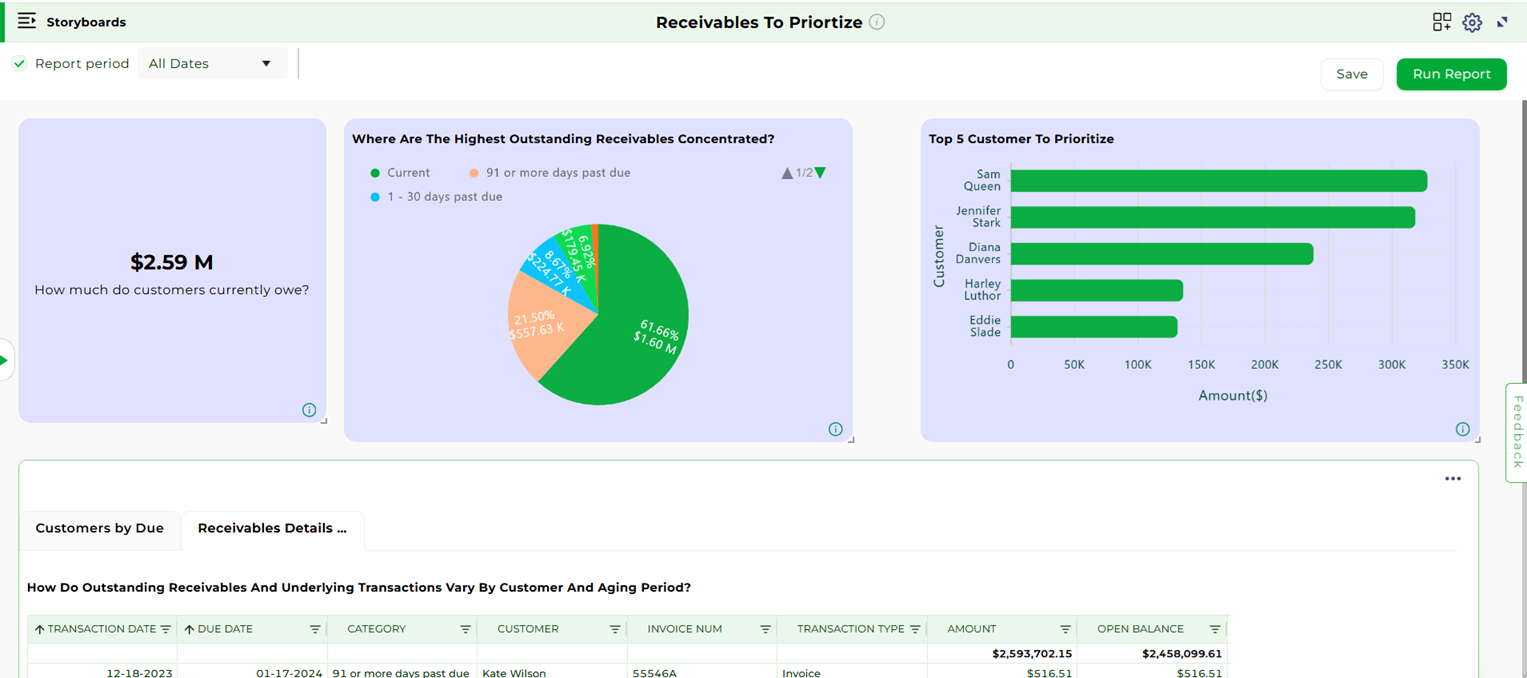

Receivables to Prioritize

Focuses on outstanding Receivables and prioritizes collections based on due Dates, Customer History, and Risk levels. Improves working capital management and reduces overdue payments.

Receivables to Prioritize#

Financial Health Check#

The Financial Health Check storyboards provide a consolidated view of an organization’s financial stability and revenue performance, helping leadership teams monitor fiscal wellbeing.

The following are the storyboards available in Financial Health Check:

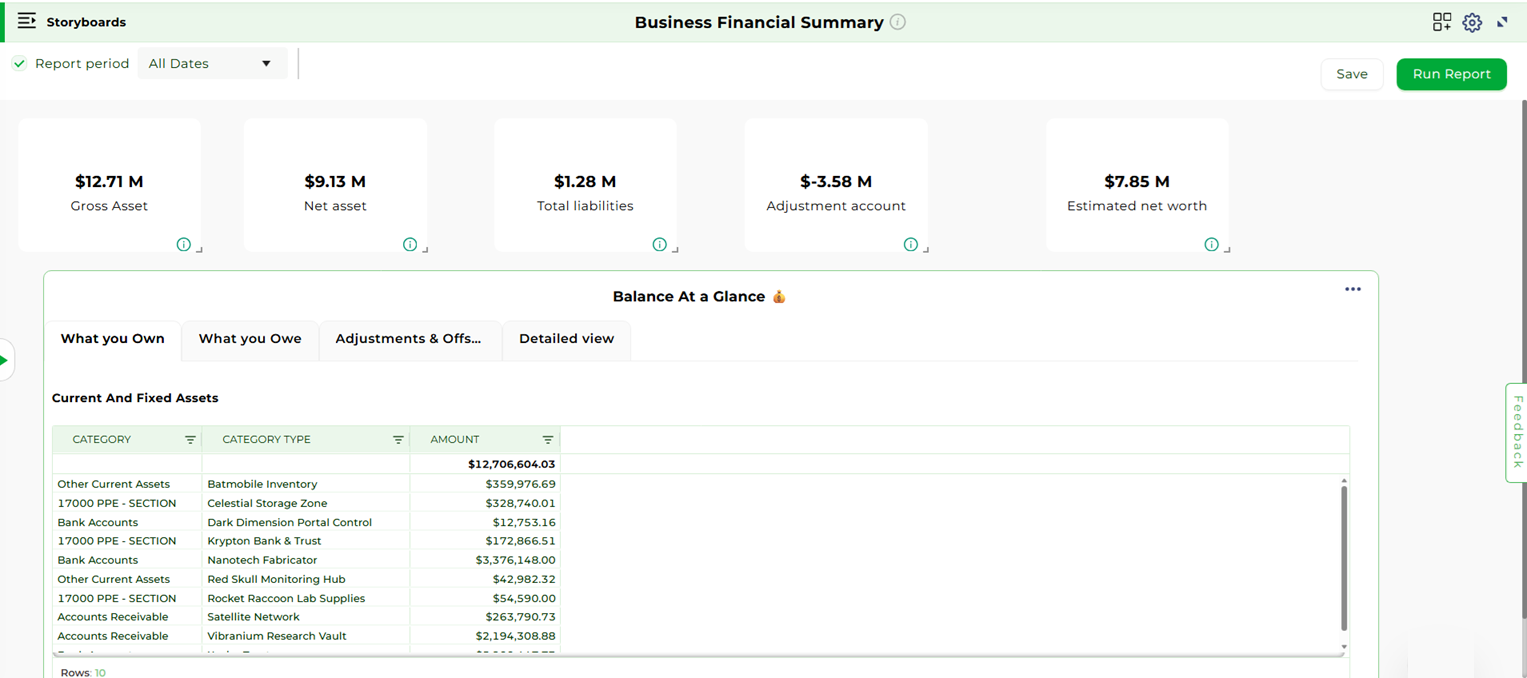

Business Financial Summary

Presents a snapshot of key financial Metrics including assets, liabilities, and equity. Helps evaluate overall financial position and balance sheet trends over time.

Business Financial Summary#

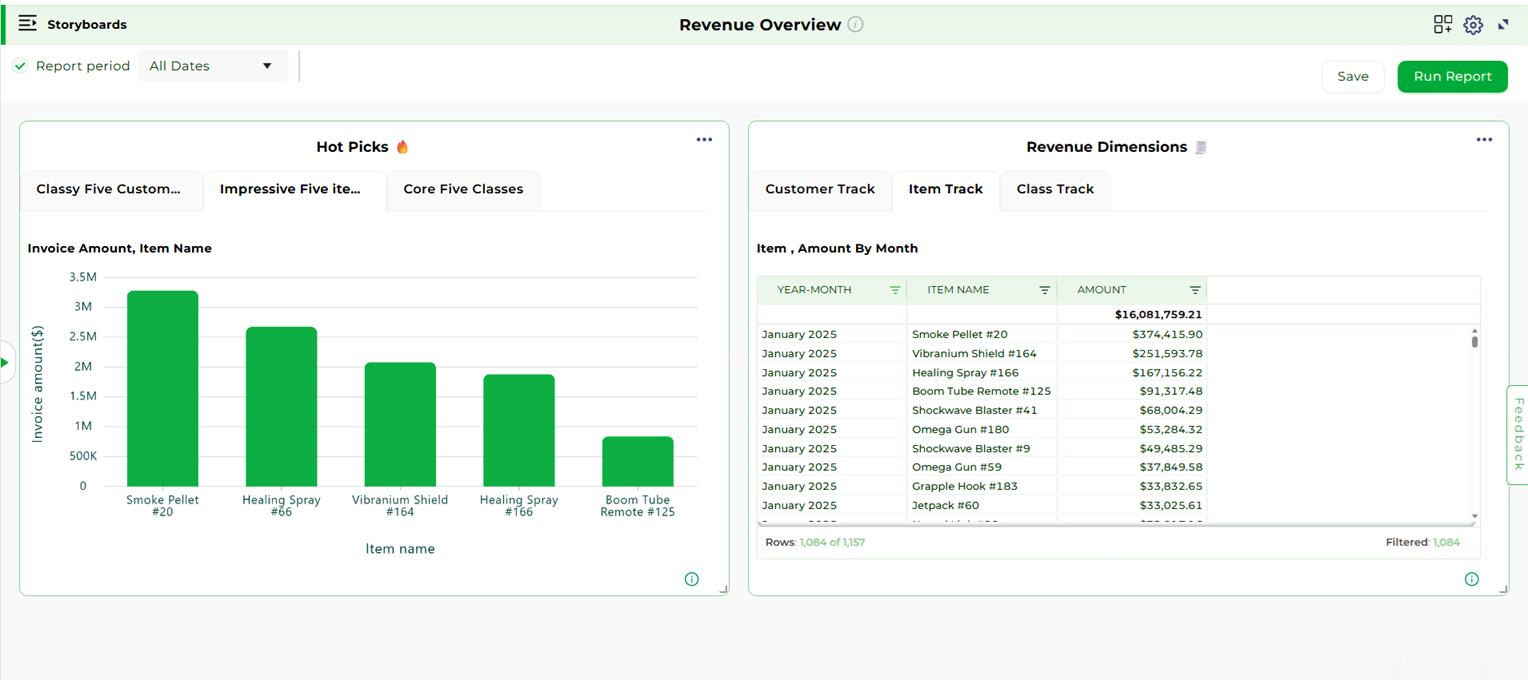

Revenue Overview

Summarizes Revenue Streams, Growth Trends, and Performance by Product, Service, or Customer Segment. Supports strategic revenue planning and forecasting.

Revenue Overview#

Invoice Collections#

The Invoice Collections storyboards help finance teams manage accounts receivable, monitor collection efficiency, and identify growth opportunities.

The following are the storyboards available in Invoice Collections:

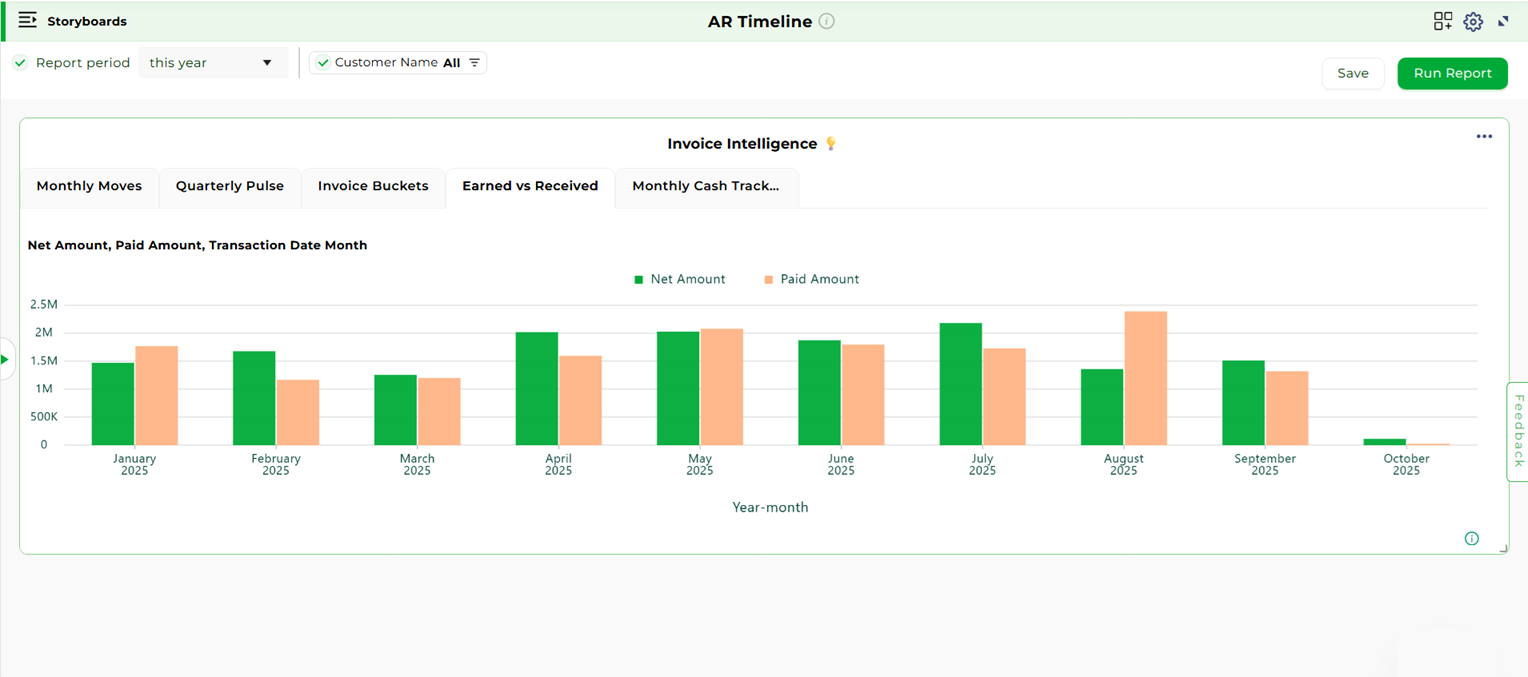

AR Timeline

Displays a view of accounts Receivable Transactions, highlighting overdue invoices and payment timelines. Assists in tracking collection progress and predicting future cash inflows.

AR Timeline#

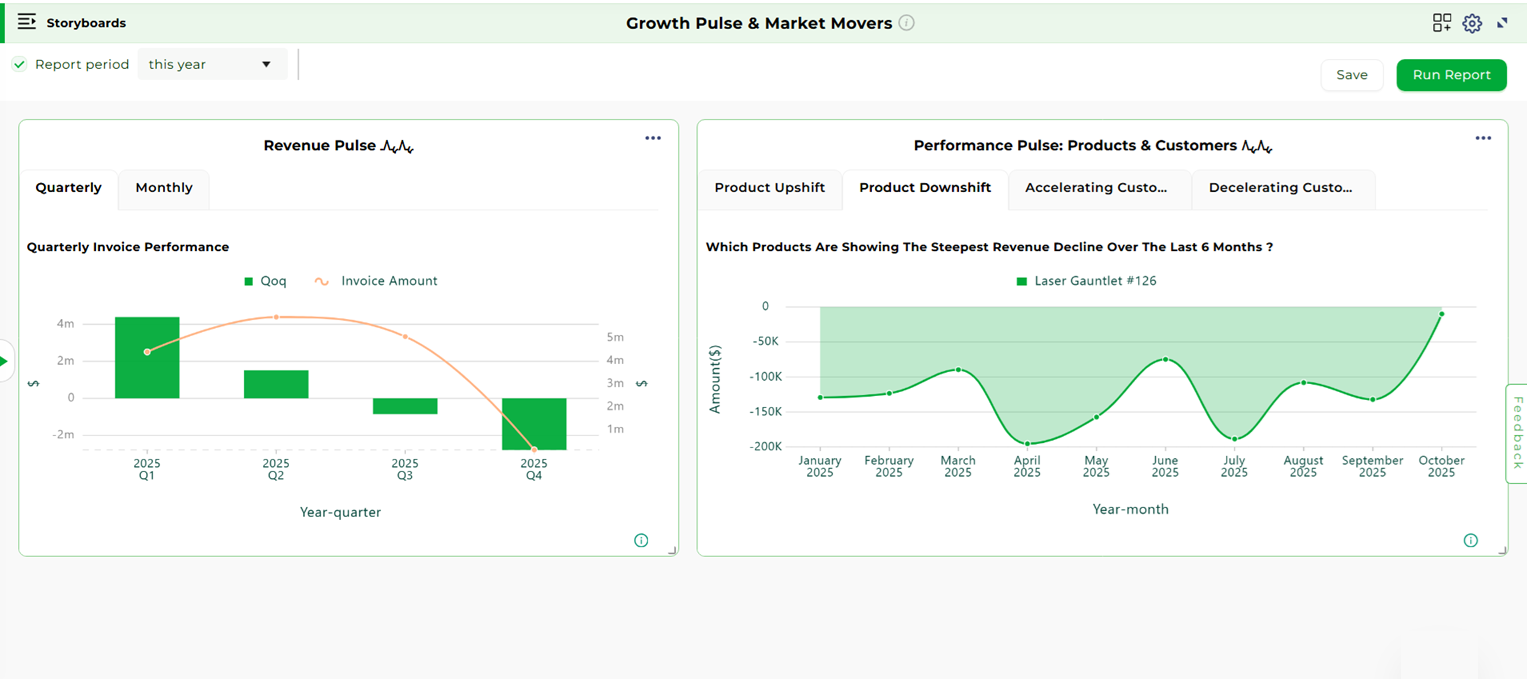

Growth Pulse & Market Movers

Provides insights into Sales Growth, Market Dynamics, and Top-Performing Customers. Enables identification of emerging trends and areas of opportunity for revenue expansion.

Growth Pulse amd Market Movers#

Procurement and Payables#

The Procurement and Payables storyboards offer a comprehensive view of supplier management and cash outflows, ensuring cost efficiency and timely vendor payments.

The following are the storyboards available in Procurement and Payables:

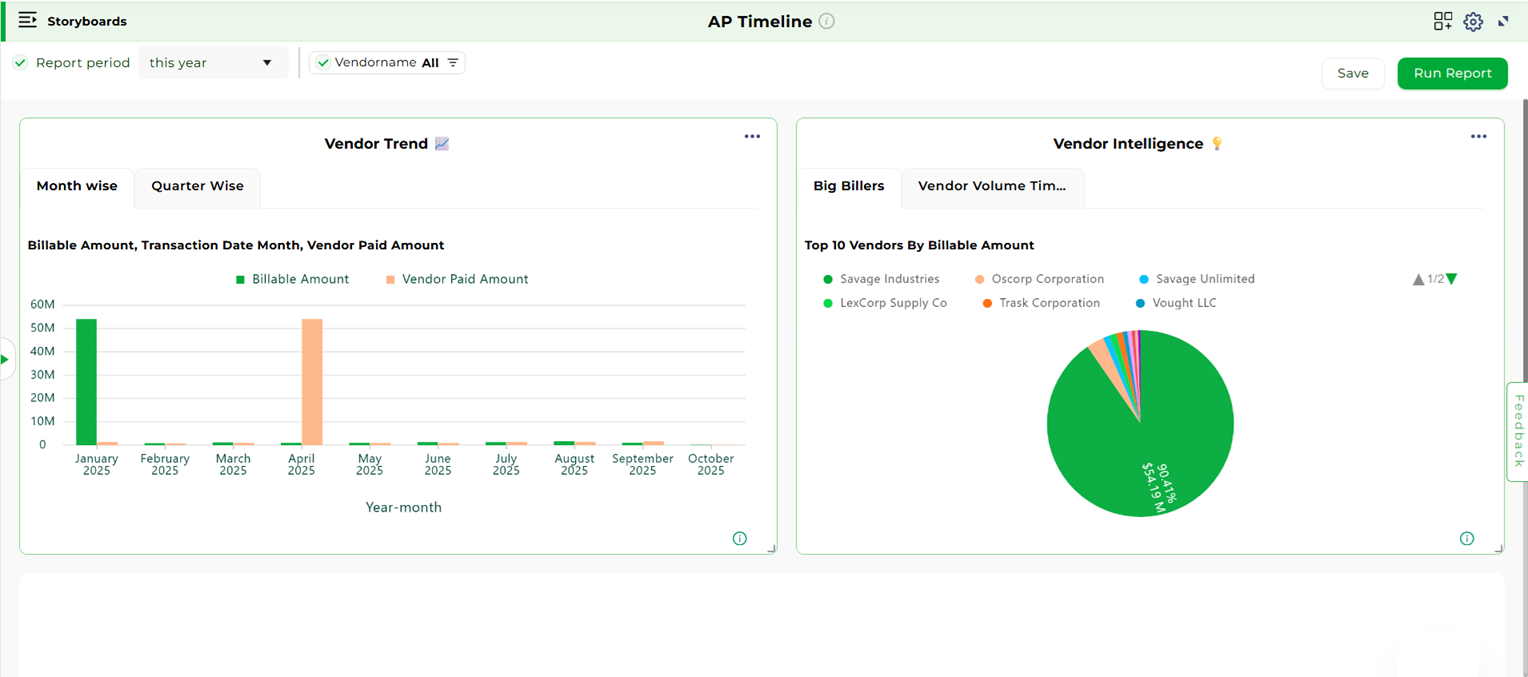

AP Timeline

Visualizes the accounts payable Lifecycle, Tracking Invoices, Approvals, and Payments. Helps identify bottlenecks in payment processing and maintain healthy supplier relationships.

AP Timeline#

Supplier Pulse & Cost Movers

Monitors Supplier Performance, Cost Fluctuations, and Purchasing Trends. Supports strategic sourcing and cost optimization decisions.

Supplie Pulse and Cost Movers#